Great Service Starts Here

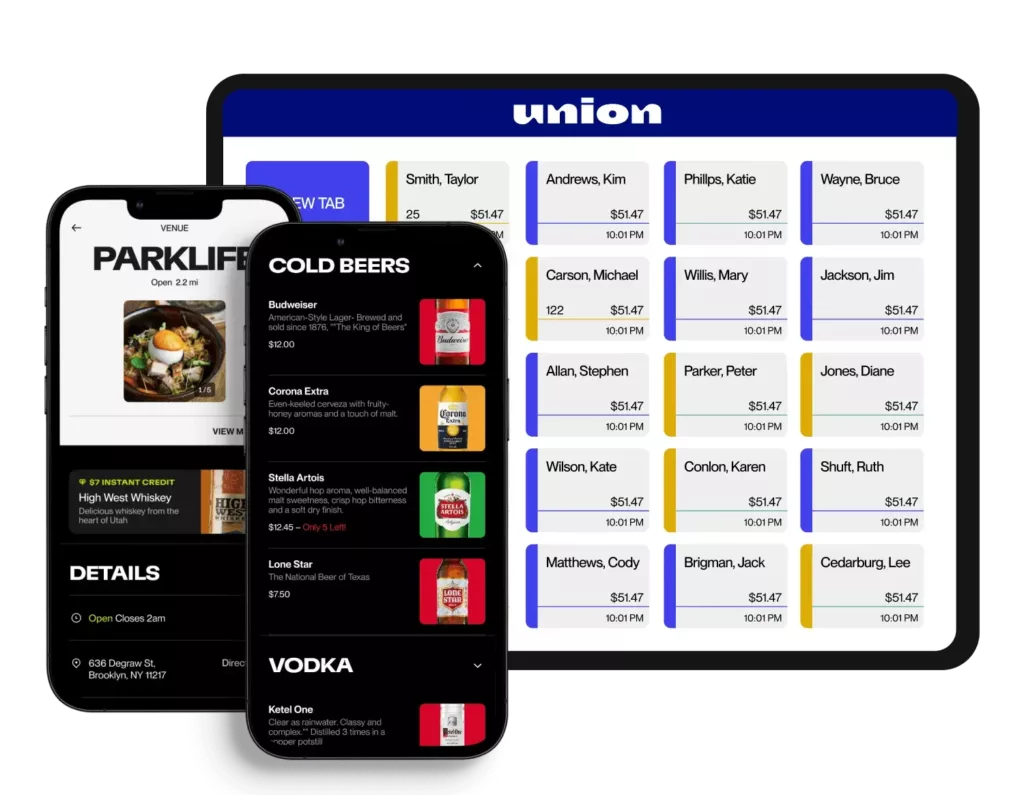

Discover the only modern POS operating system built for high volume hospitality that revolutionizes operations to make profits soar. Our modern tech rewards guests, increases service speed and makes everyone more money!

VENUES

Union is a modern hospitality operating system, built for busy bars & restaurants by industry veterans, that is proven to improve guest experiences and make bars and bartenders more money. Our tools remove the pain points that are holding you back from your busiest day ever.

Improved Staff Efficiency

Increased Guest Spending

Incredible Delight & Loyalty

CONSUMERS

Union offers a user-friendly mobile app that allows guests to browse menus, order drinks, and pay without waiting.

Drinks are delivered shockingly fast, and they have the opportunity to earn rewards and status.

No More

Waiting

Easy

Order & Pay

Loyalty Rewards & Status

BRANDS

Union’s OnPrem Impact Network delivers breakthrough opportunities and insights that turn first-time triers into all-the-time buyers.

On-Premise Impact Network

Bring

Liquid to Lips

Actionable Data Intelligence

VENUE PARTNERS

Union powers the busiest bars and restaurants across the U.S., elevating them from lively to legendary.

Union’s OnPrem Insights provide the most comprehensive, granular, precise view of on-premise consumer behavior.